Best 06 Budgeting Apps for 2024.

Managing personal finances has never been more critical, and with the advent of budgeting apps, it’s become easier and more efficient. These tools help track spending, set savings goals, and ensure financial health. As we enter 2024, here are the top 6 budgeting apps that can help you take control of your finances.

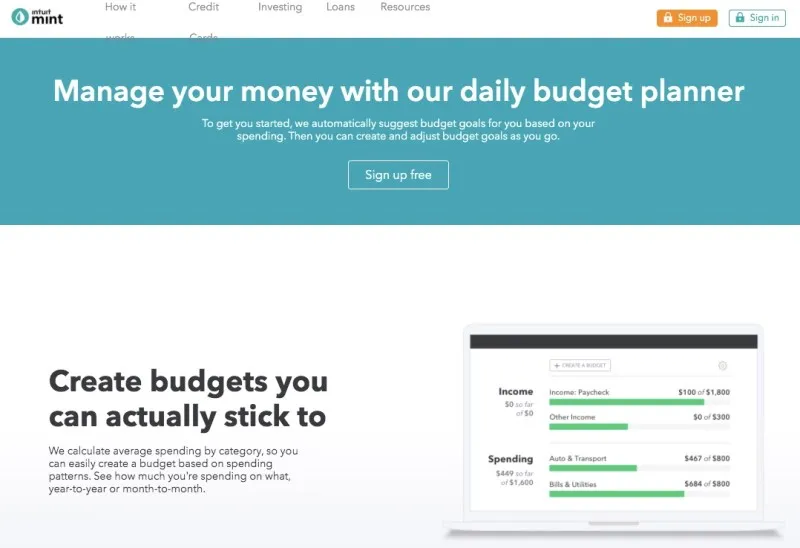

1. Mint

Overview

Mint, a product of Intuit, is a popular budgeting app that offers a comprehensive overview of your financial life. It links to your bank accounts, credit cards, and bills, providing real-time updates on your spending and savings.

Features

- Expense Tracking: Automatically categorizes transactions, making it easy to see where your money is going.

- Budget Creation: Allows users to create customized budgets and set spending limits for different categories.

- Bill Reminders: Alerts for upcoming bills to avoid late fees.

- Credit Score Monitoring: Free credit score monitoring and tips for improvement.

Why It’s Great for 2024

Mint continues to be a robust tool with frequent updates and new features. It integrates well with various financial institutions, ensuring that your financial data is always up-to-date.

2. YNAB (You Need A Budget)

Overview

YNAB is designed to help users take control of their money by following a zero-based budgeting system. It emphasizes proactive planning and conscious spending.

Features

- Goal Tracking: Helps set and track financial goals.

- Reports: Detailed reports on spending, income, and net worth.

- Account Syncing: Syncs with bank accounts to import transactions.

- Workshops and Tutorials: Offers educational resources to improve budgeting skills.

Why It’s Great for 2024

YNAB’s focus on financial education and its unique approach to budgeting make it a standout choice. Its workshops and tutorials are particularly beneficial for those looking to enhance their financial literacy.

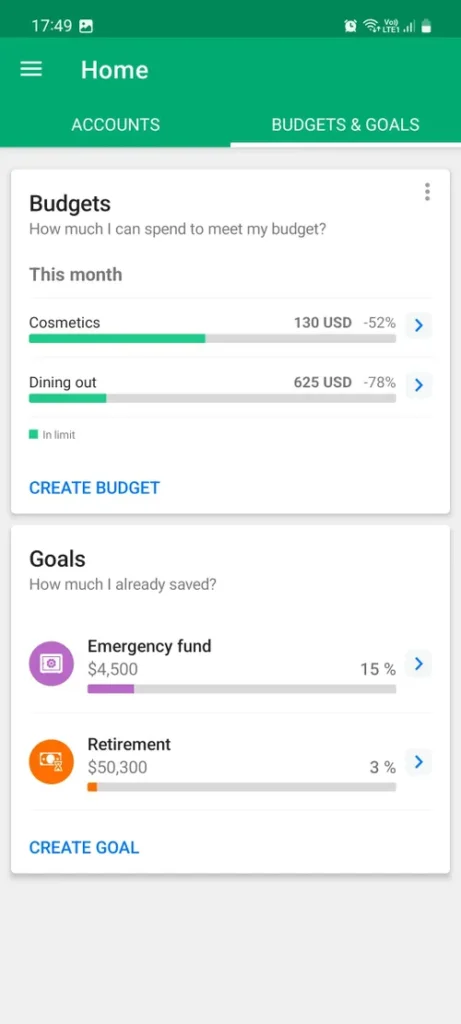

3. PocketGuard

Overview

PocketGuard is all about simplicity and ease of use. It provides a clear picture of how much disposable income you have after accounting for bills and necessities.

Features

- In My Pocket: Shows how much money is available for spending after covering bills, goals, and necessities.

- Customizable Categories: Allows users to create and manage their own budget categories.

- Subscription Tracking: Identifies and tracks recurring subscriptions to help manage regular expenses.

- Security: Uses bank-level encryption to protect your financial data.

Why It’s Great for 2024

With its user-friendly interface and focus on disposable income, PocketGuard is perfect for those who want a straightforward way to manage their finances without getting overwhelmed by details.

4. Goodbudget

Overview

Goodbudget is a digital version of the envelope budgeting system. It’s excellent for couples and families who want to share a budget.

Features

- Envelope Budgeting: Allocate money to different spending categories or “envelopes.”

- Multiple Device Sync: Syncs across multiple devices, making it easy for partners or family members to stay on the same page.

- Debt Tracking: Helps manage and pay off debt with dedicated envelopes.

- Reports: Provides insightful reports on spending and budget performance.

Why It’s Great for 2024

Goodbudget’s shared budgeting feature makes it ideal for households looking to manage finances together. Its envelope system is intuitive and easy to follow, making it suitable for all budgeting levels.

5. EveryDollar

Overview

Developed by Ramsey Solutions, EveryDollar is based on Dave Ramsey’s principles of financial planning. It promotes a zero-based budgeting approach and is great for those following Ramsey’s financial advice.

Features

- Zero-Based Budgeting: Every dollar is allocated a job, ensuring all income is planned for.

- Expense Tracking: Easily track expenses and adjust your budget as needed.

- Debt Payoff Planner: Tools and strategies to help users get out of debt.

- Integration: Connects with your bank for seamless transaction imports (premium version).

Why It’s Great for 2024

EveryDollar is excellent for users who appreciate a structured approach to budgeting. Its focus on debt payoff and financial planning aligns well with those following Dave Ramsey’s teachings.

6. Spendee

Overview

Spendee is a visually appealing app that helps users track expenses and create budgets. It supports multiple currencies, making it ideal for international users.

Features

- Custom Budgets: Create budgets for different spending categories.

- Shared Wallets: Allows for shared expenses with family or friends.

- Bill Tracker: Reminders for upcoming bills and payments.

- Multi-Currency Support: Handles multiple currencies, great for travelers.

Why It’s Great for 2024

Spendee’s user-friendly interface and multi-currency support make it a versatile choice for a global audience. Its shared wallets feature is also beneficial for managing joint expenses.

Conclusion

Choosing the right budgeting app depends on your specific financial needs and goals. Whether you’re looking for a straightforward expense tracker or a comprehensive financial planner, there’s an app on this list to suit your requirements. As of June 2024, these budgeting apps offer the best tools and features to help you take control of your finances, save more, and spend smarter. Start using one of these apps today to pave the way for a healthier financial future. For Budgeting Tips For Beginners: How To Start A Budget in 2024.–CLICK HERE